Ohio Mineral Rights Acquisition

Professional solutions for Ohio mineral owners in the Utica and Marcellus Shale formations. Whether you're interested in selling your mineral rights for immediate financial gain or exploring your options, Utica Energy Holdings offers expert guidance and competitive offers.

The Growing Energy Market in Ohio

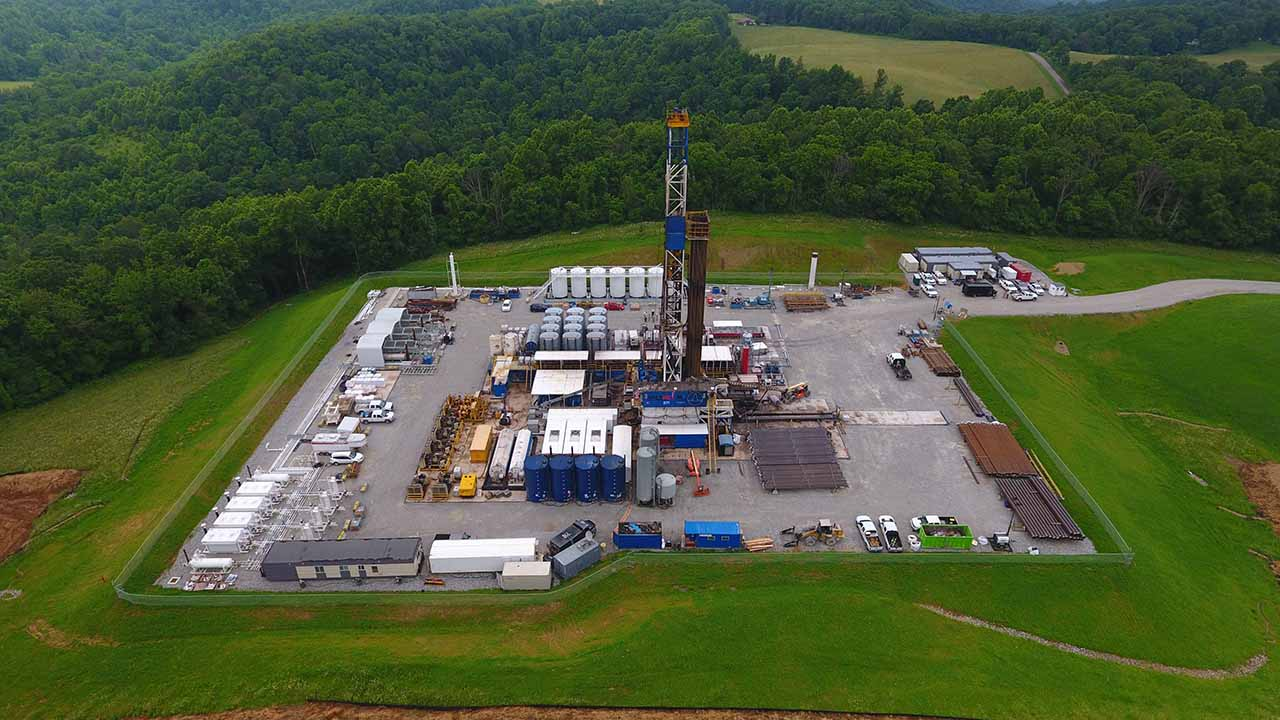

Ohio plays a central role in the U.S. energy market, primarily due to the Utica Shale formation. This formation, one of the most significant natural gas and oil reserves in the eastern United States, has driven Ohio's emergence as a major energy producer. With continued development and established infrastructure, the state presents excellent opportunities for mineral rights owners.

Eastern Ohio counties have seen substantial development, with operators investing billions in production operations, pipeline infrastructure, and processing facilities. This robust activity creates a competitive market for mineral rights acquisitions.

Why Choose Ohio for Mineral Rights?

The Utica Shale is one of the richest sources of natural gas and oil in the eastern U.S., providing significant opportunities for mineral rights owners.

As a critical energy source, Ohio sees constant interest from operators, ensuring competitive offers for landowners looking to sell their mineral rights.

Well-established pipelines and robust infrastructure support efficient extraction and transportation of resources throughout the region.

Key Geological Formations in Ohio

Ohio's natural gas and oil production is centered around two major shale formations, each offering unique opportunities for mineral rights owners.

Located in the Appalachian Basin, the Utica Shale is one of the most productive formations in Ohio. Rich in natural gas and oil, this deep formation has been the focus of extensive development across eastern Ohio counties including Harrison, Belmont, Carroll, and Monroe. Modern extraction techniques have unlocked tremendous value from this formation.

Above the Utica Shale lies the Marcellus Shale, which extends into eastern Ohio from Pennsylvania and West Virginia. While less developed in Ohio compared to neighboring states, the Marcellus still holds significant natural gas reserves and provides additional value in select counties where both formations are present.

Why Sell Your Ohio Mineral Rights?

Immediate Access to Funds

Selling provides you with a lump sum payment to address financial needs, invest elsewhere, or simplify your estate planning.

Avoid Market Uncertainty

Selling eliminates exposure to fluctuating commodity prices and operational risks associated with oil and gas production.

Simplify Asset Management

Transfer the responsibility of managing royalties and mineral operations, streamlining your financial management.

Fair, Competitive Offers

Work with experienced professionals who understand Ohio's market and provide transparent, competitive valuations.

Understanding Mineral Rights vs Surface Rights

Many landowners are surprised to learn that owning property doesn't always mean owning everything beneath the surface. In Ohio, mineral rights and surface rights can be legally separated.

| Type | Who Receives It | Common Form |

|---|---|---|

| Mineral Rights | Resource owner | Royalty payments (typically 12.5-20%) |

| Surface Rights | Surface owner | Lease payments or damage fees |

Important to Know:

- Mineral rights can be sold separately from surface rights

- Check your deed or title documents to confirm ownership

- Professional title research ensures clear ownership before transactions

Frequently Asked Questions

Mineral rights are the ownership rights to underground resources such as oil, natural gas, coal, and other minerals beneath the surface of your property. These rights can be separate from surface rights and can be leased or sold to energy companies.

You can find this information in your property deed or title documents. A professional title search by a land attorney or title company can confirm mineral rights ownership. County recorder offices also maintain public records of mineral rights ownership.

Several factors influence value including: location and geological formation, current production status, existing lease agreements, proximity to active wells, current commodity prices, and overall market conditions. Our team evaluates all these factors to provide accurate valuations.

The timeline varies based on title complexity and due diligence requirements. Typically, the process takes 30-60 days from initial offer to closing. We work efficiently to ensure a smooth transaction while conducting thorough title research.

Yes, selling mineral rights typically results in capital gains tax. The specific tax treatment depends on factors like how long you've owned the rights and your overall tax situation. We recommend consulting with a tax professional to understand your specific circumstances.

Get Your No-Obligation Offer

Provide your contact details and information about your mineral interests below. A representative from Utica Energy Holdings will get in touch with you shortly.